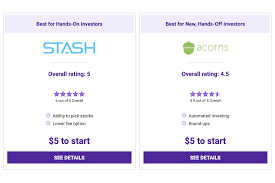

Beginners who want their money to grow but may not have the time or knowledge to manage it are the target audience for investment apps like Acorns and Stash. What app would be best for you, though? The answer is based on the features you require, the types of investments you want to make, your price range, and other features each app offers. You can learn more about the Acorns and Stash in this article. Please keep reading.

Acorns

The following service plans are provided by Acorns:

- Personal – You receive an individual investment account, an IRA (traditional, Roth, or SEP), and a cash management account at this level. Each month, it costs $3.

- Family – In addition to the features of the entry-level, this level allows you to open as many child custody accounts as necessary. The monthly fee for this level is $5.

You can put money into pre-selected exchange-traded fund (ETF) portfolios using the investing account from Acorns. Additionally, you’ll have the option to set up recurring investments and take advantage of “round-ups,” which let you invest the spare change from regular purchases.

Pros

- No account minimums

- Commission-free investments

- Acorn Round-Ups invests your spare change from purchases

- ETF portfolios are tailored to your risk tolerance and investment goals

- Automated custodial investment accounts for kids

Cons

- You can’t invest in specific companies; Acorns assigns and manages your portfolio for you

- If you don’t invest regularly, monthly fees could be high compared to other automated advisors like SoFi

You may be interested in Acorn Vs BritBox: Which Is The Better Streaming Service?

Stash

The following service plans are available from Stash:

- Stash Beginner – The “Stock Back” debit card, a cash management account, $1,000 in life insurance, and an individual investment account that enables you to purchase stocks and ETFs are all included in this entry-level package. Monthly fees for this account are $1.

- Stash Growth – The benefits of the entry-level tier are included in the middle tier, along with a Smart Portfolio, a managed portfolio, and a retirement account (traditional IRA or Roth IRA). The monthly fee for this account is $3.

- Stash+ – The benefits of the two lower levels plus custodial accounts, double Stock Back debit card bonuses, premium investment advice, and $10,000 in life insurance are all included at the highest level. The monthly fees for this account are $9.

You can select from a wide range of ETFs and individual stocks with Stash’s investing account, starting at the entry tier. Therefore, you must be aware of the items you wish to purchase. Your access to Smart Portfolio, which handles your investments, is only available at the second tier of service.

Pros

- No minimum to get started; Round-Ups invests spare change from purchases

- You can choose your investments, but automatic investing tools are also available

- Accounts include a Stock-Back card, online banking options, and life insurance

- Smart Portfolios invests your money into a custom ETF portfolio that aligns with your risk tolerance

Cons

- Compared to Acorns, monthly fees are higher for custodial investment accounts

- Smart Portfolios automated investing is only available at higher pricing levels

Differences Between Acorns And Stash

Investment Choices And Costs

For investors trying to build their portfolios with the exact components they want, Stash offers a ton more options in this area.

Acorns offer five pre-selected portfolios in its core portfolio option, ranging in risk from conservative to aggressive. Additionally, Acorns provides four sustainable portfolios that include ESG funds and give you more focused access to businesses that fit those standards.

You can choose from 22 ETFs, all of which are low-cost funds, for these two different types of portfolios. The expense ratios for these funds range from 0.03 to 0.25 percent, or $3 to $25 annually for every $10,000 invested.

If you choose to invest in the riskier (i.e., stock-heavy) portfolios, your overall portfolio will cost close to the lower end of that range.

Additionally, Acorns enables users to designate up to 5% of their taxable portfolio to a fund invested in the Bitcoin cryptocurrency. But the fund has a high expense ratio of 0.95 percent.

The best of both worlds is possible with Stash: You can manage your portfolio on your own using the company’s Smart Portfolios, or you can purchase ETFs and individual stocks on your own.

Cash Management Accounts

Both Acorns and Stash provide robust cash management accounts.

The following capabilities are available with Acorns’ cash management account:

- Direct deposit, up to 2 days early

- Mobile check deposit and check-writing

- “Round-ups” to invest your spare change

- 55,000 fee-free ATMs in the U.S. and globally

- Automatically deposit money into investment accounts

- FDIC insured up to $250,000

The entry-level account will grant you access to all of these features.

The following features are available with Stash’s cash management account:

- No overdraft or account maintenance fees

- 19,000 fee-free ATMs across the U.S.

- Instant deposit at retailers

- Instant transfers between Stash accounts

- “Stock Back” card for spending rewards in stock

- Direct deposit, up to 2 days early

- Mobile check deposit and check-writing

- Recurring transfers

- FDIC insured up to $250,000

As a result, Acorns and Stash compete favorably on some of the key characteristics of cash management accounts and each company provides a robust account with a variety of features.

Account Types

The number of account types at either Acorns or Stash is significantly less than it is for traditional brokerage accounts, but most investors will probably find them sufficient.

Acorns provide individual taxable investment accounts and retirement accounts, such as traditional IRAs, Roth IRAs, SEP IRAs, and rollover IRAs, at its entry-level tier. The cash management account is also included in the fundamental package.

You’ll have access to a custodial account if you want to move up to the next tier, which can encourage your kid to start investing.

Stash provides access to both the cash management account and an individual taxable investing account at its entry-level. As you move up the tiers, you gain access to managed portfolios as well as retirement accounts like traditional and Roth IRAs. You can access custodial accounts for minors if you choose Stash’s highest tier.

Transfer Fees

Transfer fees are the kind of thing you don’t think much about until it really hurts you. There aren’t many companies that charge fees to transfer your investments into an account, but most do if you want to take your investments with you.

Additionally, paying the fees rather than selling your holdings and transferring the proceeds as cash may make sense if you’re sitting on significant gains.

When it comes to fees for moving your positions, there is a clear winner. Acorns charge $50 per ETF to move your account to another broker.

On the other hand, Stash charges $75 per account, which is basically in line with what most companies charge. Even if you only have a few ETFs, that is a significant difference. The cost won’t matter, of course, if you intend to stick with Acorns.

Bottom Line

Your individual needs and expectations will strongly influence which app, Stash or Acorns, is superior. Both offer numerous comparable features as part of a monthly subscription.

Acorns is probably a better option if you need access to a SEP IRA. Additionally, Acorns Earn can assist you in taking rebate shopping to the next level because any money you receive in return is invested, multiplying the benefit over time.